Bring Your Boiler Room to Optimum Efficiency at No Cost

What is PACE and What are the Benefits?

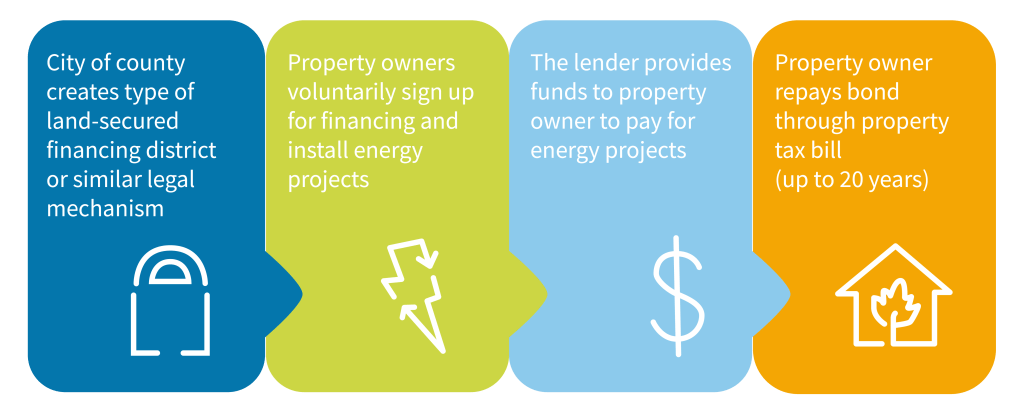

Have you heard of PACE Financing? PACE or Property Assessed Clean Energy Financing is an innovative solution for building owners interested in upgrades in efficiency. Most business owners decide to wait until something breaks to replace or enhance equipment since most of these upgrades involve significant up-front costs. But with PACE Financing, you eliminate those upfront costs making it easier for you to handle large upgrade projects and bring your boiler room to optimum efficiency at no cost.

Why is this being offered?

If it sounds too good to be true, it probably is… Right? Not in this case. PACE Financing is being offered to virtually all commercial business owners in Minnesota. Why? In 2022, Congress passed the Inflation Reduction Act. This Act states it will combat the climate crisis, reduce the deficit, and ask large corporations to pay their fair share. PACE Financing was introduced to make this possible. This allows large corporations to comply with the Inflation Reduction Act without losing profits themselves. Take advantage while it is offered!

What are the qualifications and requirements?

PACE Financing is a great way to improve your entire plant for your employees, the environment, and your bottom line.

You can upgrade the following using PACE:

- HVAC Systems

- Lighting

- Building Envelope

- Energy Management Systems

The following costs may also be rolled into the PACE agreement:

- Energy audits/renewable energy studies (REQUIRED)

- Installation costs (Self-Installations do not qualify)

- Solar, Wind, and Geothermal Equipment Costs

- Energy Evaluations

- Design, drafting, engineering, labor costs

- Permit fees

- Inspection charges

Of course, there are certain restrictions. Qualifying business must also meet the following criteria to qualify:

- Energy audits/renewable energy studies (REQUIRED)

- Equipment costs

- Installation costs

- Energy Evaluations

- Design, drafting, engineering, labor costs

- Permit fees

- Inspection charges

What does this mean for you?

PACE Financing cover 100% of all project costs. Then, payments are repaid through a special property tax assessment with terms up to 20 years. You will most likely be able to pay back this loan long before 20 years is up with the money you will save on energy. Other benefits include:

- Invest in energy efficiency projects with no upfront costs.

- Utility savings will exceed your payment obligations making investments cash positive.

- The special tax assessment is made payable twice/year with your property taxes. The first payment will be due in May of the following year.

- PACE is tax neutral with no financial exposure to cities/counties.

- Energy improving investments promote local jobs.

How does Apex utilize PACE?

The Apex team is familiar with PACE Financed projects. First, our team will evaluate your plant alongside a certified energy engineer. Next, we will devise a proposal that will show you the initial cost of the project (covered by PACE), your bi-annual cost in taxes, and the payback calculator of the project that will show everything you will save on energy annually. We can provide everything you need to bring your plant into the 21st century of energy efficiency while saving you as much time and money as possible! Contact us today and get started with your PACE assessment.